PULSE 2025

From Stability to Speed:

How AI and Client Dynamics Are Reshaping Agencies

Welcome to The Pulse - the CMA’s Agency Trends Snapshot

Our quarterly deep-dive into the shifts, challenges and opportunities shaping the content marketing landscape.

Every quarter, we ask our community to share what’s really happening in their agencies, giving us a real-time view of how the market is moving. Your insights help build a collective picture that benefits us all – whether you’re spotting new opportunities, checking how you measure up or rethinking how you work with clients.

This is what we found…

Every quarter, we ask our community to share what’s really happening in their agencies, giving us a real-time view of how the market is moving. Your insights help build a collective picture that benefits us all – whether you’re spotting new opportunities, checking how you measure up or rethinking how you work with clients.

This time, we sent the survey to our community of over 9,000 people and analysed the responses from those who completed it. We then compared the results from Q1 to Q2 to see what’s shifting, what’s speeding up and what’s emerging.

And this is what we’ve found…

The Q2 results show an industry balancing caution with pragmatism. New client opportunities may be softening, but marketing spend is holding firm. And agencies are evolving their delivery models, weaving AI into everyday work and re-emphasising the value of in-person connections.

Read on to find out exactly what we discovered, what it means for you and your agency, and, most importantly, what you can do now to prepare for the future and set yourself up for success.

Thank you again for your participation,

Rob John,

CMA Managing Director

Zoe Francis-Cox,

CMA Chair

Sections

-

The Market

Covers trends, opportunities and challenges within the wider industry landscape.

-

Agency operations & business health

Internal culture, structure, strategy and brand positioning.

-

Clients

Examines efficiency, processes, wellbeing and overall organisational performance.

-

Technology

Explores tools, systems and innovations that support delivery and competitiveness.

TL;DR

1. Client opportunities have stabilised – and that’s good news

The market isn’t surging, but it’s not shrinking either. Fewer highs, fewer lows: a steady pipeline that rewards depth over speed.

2. Average conversion times have polarised

The middle ground of 3-6 month deals is vanishing. Content strategies need to work for both the sprint and the marathon.

3. Hiring is up – a sign of sector confidence

More agencies are recruiting (52% → 67%), suggesting teams are gearing up for capacity and capability growth.

4. Client spend is steady

“Same as last quarter” jumped from 48% to 73%. That’s not growth, but it’s a marked improvement from earlier volatility – a stable base to plan from.

5. Referrals still lead the pack

They’ve edged up again, now accounting for 67% of new business. Word of mouth remains the single most powerful growth lever.

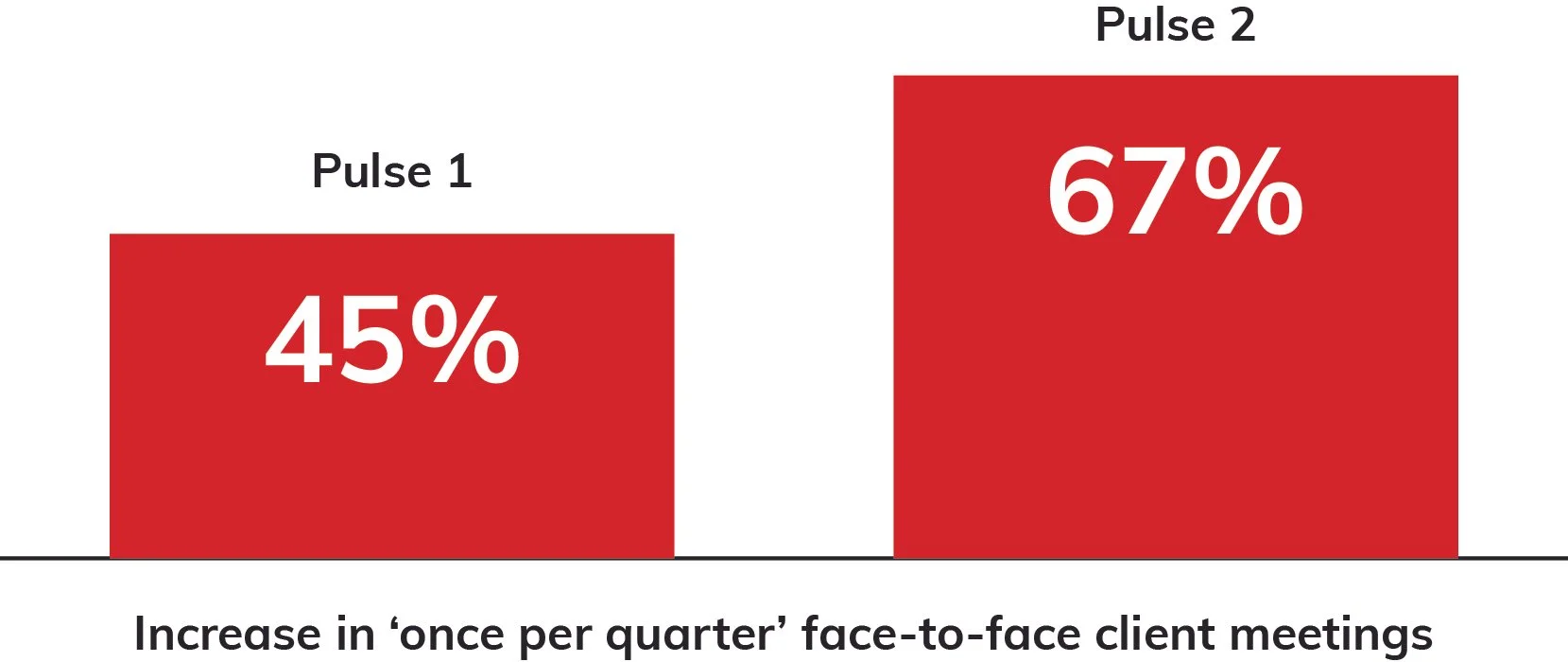

6. Face-to-face meetings are polarising

More agencies meet clients once a quarter (45% → 67%), but mid-frequency meetings are down and the “never meet” group is growing too. Relationships are either light-touch or high-intensity, – not much in between.

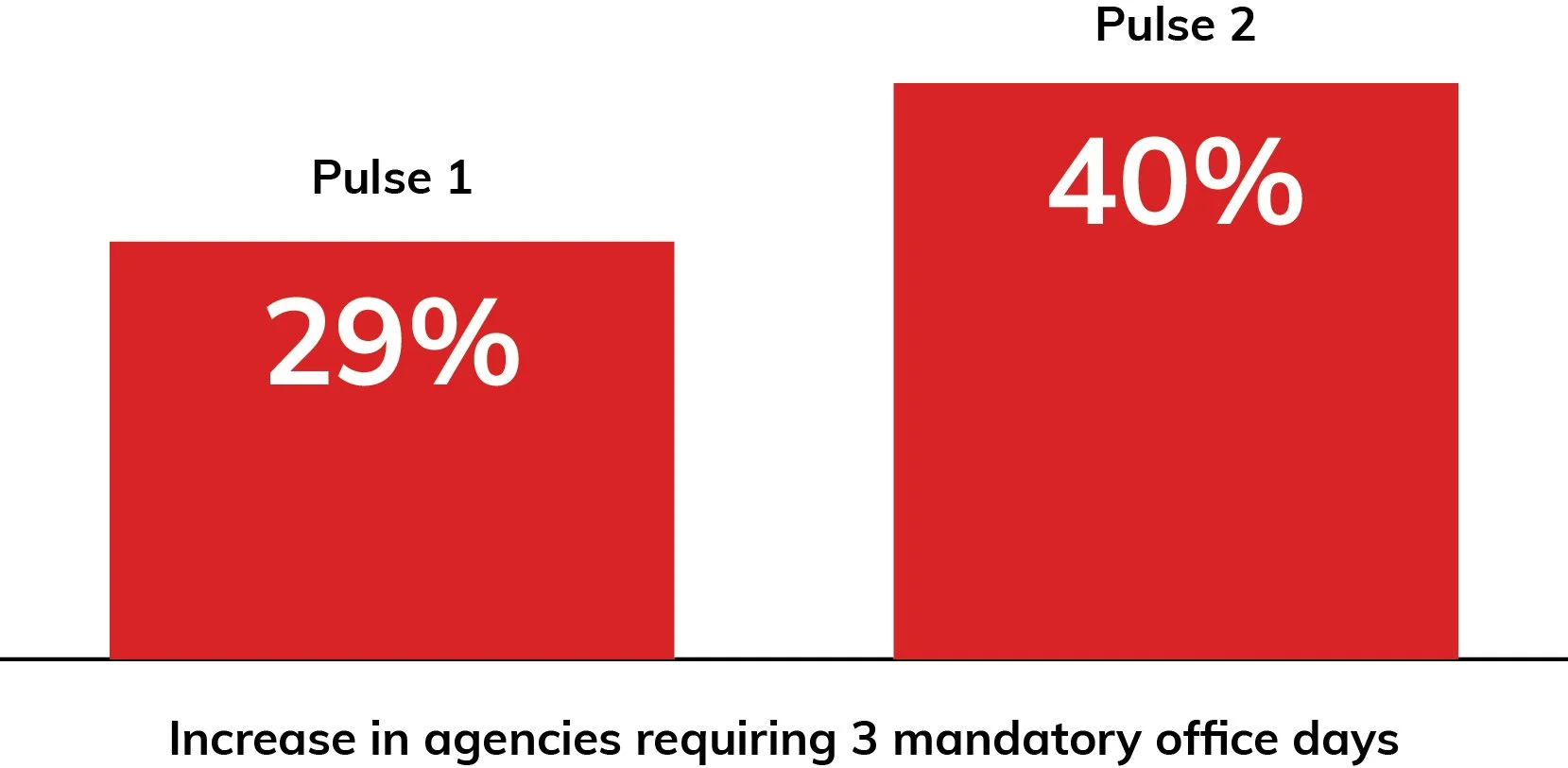

7. Mandatory office days are converging on three per week

Three days in office rose from 29% to 40%, while 0 and 2 days dropped and 4+ days disappeared. Agencies may finally be shifting away from full-remote norms.

8. AI adoption is fast and broad

AI isn’t just testing – it’s becoming embedded across workflows, especially in creative output.

The Market

Market demand and opportunity pipeline – from chasing growth to maximising momentum

The move from volatile to stable pipelines doesn’t mean opportunity is shrinking - it means growth will increasingly come from depth, not breadth. Faster decision windows require readiness with content that can deliver immediate impact, while the enduring dominance of referrals demands advocacy-focused storytelling. Understanding your position on the project-retained spectrum will sharpen your content approach and make your campaigns more commercially aligned.

1. New client opportunities – a shift towards stability

Instead of a market where agencies are either surging ahead or losing ground, most now report no big change from quarter to quarter. That’s a shift from volatility to stability.

So what?

The opportunity landscape is stabilising. Big swings in pipeline growth are giving way to consistent, predictable flows. This creates an environment where growth is less likely to come from market surges and more likely to come from strategically maximising existing opportunities.

This is a retention and expansion market, not a land-grab market. Growth will increasingly come from getting more out of existing relationships – upsells, cross-sells, deeper engagements – rather than relying on sudden influxes of new business.

The opportunity

Shift resource allocation from purely top-of-funnel acquisition to deepening and expanding current accounts.

Build retention-focused content programmes that maintain engagement and demonstrate value beyond the initial sale.

2. Average conversion time – a faster decision window

The market has split into two distinct speeds for winning new business – with the middle ground shrinking fast. It’s either ‘Nice to meet you, please start tomorrow’ or ‘six months of endless to and fro until we fall, exhausted over the finish line’.

So what?

You can’t just plan for one buying timeline anymore. Agencies must be equipped to win both the sprint and the marathon – delivering high-impact, urgency-driving content for short-cycle prospects while nurturing slow-burn opportunities with consistent, high-value engagement.

The opportunity

For short cycles: create rapid-impact content assets that drive urgency - quick-win case studies, short-form proof points, ROI snapshots.

For long cycles: maintain presence with drip-fed, value-rich content such as insight reports, market commentary and strategic vision pieces that position your agency as indispensable.

3. Most common sources of new business – referrals remain dominant

Referrals remain the undisputed powerhouse of business development for content marketing agencies, rising slightly from 61% to 67% of all new business sources. In a landscape crowded with digital marketing noise, endless cold outreach and a sector sometimes criticised for inconsistent service, word-of-mouth continues to cut through.

A strong referral doesn’t just open doors – it arrives with built-in trust, credibility and proof of value. For agencies, this is a reminder that the most powerful growth engine isn’t always the newest tool in the stack – it’s delivering work so good, clients can’t help but recommend you.

So what?

Despite investments in marketing channels, human-to-human trust remains the most powerful driver of growth. For content marketing professionals, this underscores the value of content designed not just for prospects, but for advocacy by existing clients and networks.

The opportunity

Produce “share-worthy” success stories and data-driven results that clients are proud to circulate

Build structured referral enablement kits with ready-to-share content assets for satisfied clients and partners

Reward and recognise advocates

Build advocacy into client onboarding and offboarding

Turn satisfied clients into thought leadership partners.

4. Annual business mix – a polarised marketplace

The market is polarising - some agencies are almost entirely project-driven, while others are heavily retained.

So what?

This polarisation impacts how content strategies should be shaped for client acquisition and retention. For content marketing professionals, your growth strategy, pricing and content approach will need to align with the model you’re in – or the one you want to move toward.

Project-heavy agencies need high-conversion, quick-win content to keep work flowing, while retained-heavy agencies need value-building, relationship-deepening content to secure renewals and expansion.

The opportunity

For project-heavy models: create high-conversion campaign content that moves prospects quickly from enquiry to signed contract.

For retained-heavy models: focus on long-term, relationship-nurturing content that continually proves your agency’s strategic value and supports renewal conversations.

Agency Operations & Business Health

Building capacity in a stabilising market

A healthy pipeline is only as good as the agency’s ability to service it. Operational trends in hiring, client spend, client engagement and working models reveal how agencies are positioning themselves to deliver value in a market that’s shifting from volatility to stability.

1. Hiring status – signs of confidence

The share of agencies actively hiring rose from 52% in Pulse 1 to 67% in Pulse 2 – a significant jump that signals renewed confidence in the sector’s growth prospects.

So what?

This is particularly encouraging against the backdrop of the UK’s wider jobs market, where hiring activity has been uneven and many industries are still feeling the effects of economic uncertainty. For content marketing agencies, this uptick suggests teams are not only replacing roles but actively expanding capacity – investing in new skills, capabilities and service areas to meet client demand. In a climate where talent competition remains high, it’s a positive sign that agencies are willing and able to grow their teams again.

As AI adoption accelerates and automates more executional work, agency hiring may increasingly focus on hybrid strategist-technologists – professionals who can blend creative thinking with data literacy and AI fluency. This will reshape the skills mix in teams, with greater emphasis on orchestration, oversight and innovation rather than volume production.

The opportunity

Build relationships with agencies that are expanding their teams – they may be more open to bold, higher-value content initiatives.

Position yourself as a partner who can accelerate the ramp-up of new hires with content tools, templates and training assets.

2. Average service spend – budgets hold steady

Client budgets have levelled off. Most agencies are seeing spend hold steady rather than rise or fall. The volatility in client budgets has eased. Agencies aren’t seeing major increases, but they’re also not facing widespread cuts.

So what?

Budgets are not growing, but the sharp fluctuations of previous quarters have eased. Stability creates a predictable base for planning, but also means competition for incremental spend will be fierce.

If budget stability holds over the next 12–24 months, procurement and finance teams will expect agencies to win funding by proving they can deliver more within the same envelope. This could accelerate the adoption of AI-enabled production efficiencies, collaborative resourcing models and modular content strategies designed to stretch impact without increasing costs.

The opportunity

Focus on demonstrating measurable ROI within existing budgets to secure renewals and incremental upsells.

Build content campaigns that show efficiency and value – making the case for clients to reallocate spend rather than expand it.

3. Face-to-face client meetings – a polarised approach

Agencies are gravitating to two extremes – occasional strategic in-person sessions or no face-to-face contact at all. The middle ground is disappearing. This polarisation changes how relationship-building and trust are maintained.

So what?

As hybrid work patterns settle, in-person client time will likely become more of a premium, not less. That scarcity will make the quality and purpose of face-to-face interactions even more important. Agencies that design high-impact, content-rich meeting experiences – blending data-driven insight with collaborative ideation – will turn those sessions into competitive differentiators and deepen long-term account loyalty.

The opportunity

For low-frequency contacts

Make in-person sessions count by pairing them with high-value strategic content and pre/post-meeting engagement pieces. Use the time to demonstrate deep understanding of their business, share insights they can’t get elsewhere and build personal rapport – the kind of human connection that video calls can’t replicate.

For high-frequency contacts

Integrate content delivery into the rhythm of meetings to maintain momentum between sessions. Consistency here reinforces trust and shows clients you’re proactive, responsive and genuinely invested in their success.

And for all clients – regardless of meeting cadence – remember that taking the time to visit in person sends a powerful message: you care enough to show up. In an increasingly digital-first industry, that human touch can be the difference between being just another supplier and being a trusted partner.

4. Mandatory office days – leaning back towards in-person collaboration

Agencies appear to be standardising around a mid-week in-office model, potentially reversing the long-standing agency preference for looser hybrid or fully remote work.

So what?

If this three-day standard becomes entrenched, agencies could see in-office time evolve into premium creative space rather than routine desk work. Those that curate these days with structured ideation sessions, cross-team exchanges and live content production will get more tangible value from physical presence. In turn, this may shift hiring priorities toward talent that thrives in both asynchronous and high-intensity, in-person collaboration environments.

This shift could also influence collaboration styles, idea generation and creative process speed.

The opportunity

Develop content workflows and collaboration tools optimised for hybrid teams that have predictable in-office overlap.

Leverage in-office days for high-value creative workshops, client content reviews and cross-disciplinary campaign sprints.

Clients

Client relationship dynamics – trust, reactivation and the polarisation of engagement

In a stabilising market, the strength of client relationships often determines growth potential. The latest Pulse data shows how agencies are winning new business, re-engaging past clients and maintaining ongoing contact – and how those patterns are shifting.

1. Referrals remain the cornerstone of new business

Word-of-mouth is not just surviving the rise of digital channels – it’s thriving.

So what?

For content marketers, this means that while inbound tactics matter, enabling and amplifying advocacy from existing clients is the most potent growth strategy.

The opportunity

Create advocacy-ready content – success stories, performance snapshots, testimonial videos – that clients can easily share with peers.

Build referral enablement programmes with ready-to-send email templates, social posts and talking points for client champions.

2. Lapsed client reactivation – a steady but under-utilised channel

The percentage of agencies citing lapsed clients as a source of new business remained at 7% in both pulses.

So what?

The lack of movement suggests that most agencies are not actively pursuing lapsed accounts, even though these prospects already have brand familiarity and a history of engagement. This represents an untapped, potentially high-yield audience.

The opportunity

Develop targeted reactivation campaigns – personalised content that references past projects, demonstrates updated capabilities and offers re-entry incentives.

Use data-led win-back storytelling to show lapsed clients the tangible improvements you can now deliver.

3. Frequency and type of client contact – polarisation in face-to-face engagement

The middle ground of steady in-person contact is shrinking. Relationships are now either maintained through occasional strategic face-to-face sessions or conducted entirely without physical meetings. Both models demand intentional content strategies to maintain trust and momentum.

So what?

As agencies continue to polarise between “meet rarely but make it count” and “never meet at all”, the competitive edge will lie in how well you choreograph client experience across both models. Expect to see greater use of immersive virtual formats, AI-powered personalisation in digital touchpoints and more theatrically staged in-person sessions that feel less like status updates and more like strategic summits.

The opportunity

For low-frequency, high-value in-person meetings: prepare premium content packs (market insights, performance dashboards, creative prototypes) to maximise impact.

For remote-only clients: build a rich digital engagement cadence with video updates, interactive reports and collaborative content workshops to maintain connection.

Technology

Technology adoption and integration –

from experimentation to embedded AI

The latest Pulse data shows that AI is no longer a niche tool in agencies – it’s becoming an operational, editorial and creative standard. The rate and breadth of adoption over just two survey cycles signals that AI is moving from test phase to full integration across workflows.

The next competitive frontier won’t be whether agencies use AI, but how deeply and distinctively they integrate it. As AI becomes embedded, being great at prompting – knowing how to frame inputs, sequence tasks and combine tools for the best output – will emerge as a core professional skill. Agencies whose teams excel at this will consistently produce higher-quality, more original work, giving them a decisive edge in speed, creativity and impact.

1. AI in operations – streamlining the engine room

AI tools for project management, reporting, scheduling and administrative processes are becoming embedded.

So what?

This is freeing human time for higher-value tasks and enabling faster, data-informed decision-making.

The opportunity

Audit operational workflows to identify bottlenecks where AI can increase speed and reduce cost.

Train teams on AI-assisted project tracking, analytics and resource planning tools to maximise ROI on technology investments.

2. AI in editorial – mainstream, with room to deepen

Every agency is now using AI at least occasionally in editorial workflows. While the proportion using it “Often” is stable, the total penetration is universal – suggesting it’s now a baseline capability, not a differentiator.

So what?

As adoption matures, agencies will evolve from casual users to power users. The time saved on ‘research and typing’ will be reinvested into more modular, layered and creative use. Using automation to free human capacity for higher-order thinking will not just make content faster to produce, it will make it better: more interesting, more dynamic, more human.

Editorial AI will move from basic optimisation to real-time content personalisation and adaptive storytelling, while creative AI will push into new formats, blending visual, interactive and experiential media. Agencies that master orchestration across all three functions – with clear governance, brand alignment and measurable performance gains – will lead the next phase of AI-powered marketing.

The opportunity

Go beyond basic editorial assistance (grammar checks, formatting) to advanced uses – content structuring, tone optimisation, SEO-driven rewriting.

Develop editorial guidelines for AI use to ensure output meets brand, compliance and quality standards.

3. AI in creative – the most dramatic shift

Creative AI adoption has more than doubled in frequent use – the single largest adoption leap across all AI categories.

So what?

AI is no longer a novelty; it’s a standard part of the creative toolkit, shaping ideation, design and content production.

The next phase of creative AI will be defined by understanding the role of the human – and how AI can augment that for both speed and creative output. AI will take on the heavy lifting of asset creation and technical execution, but the human element – originality, emotional resonance, brand nuance – will remain essential and irreplaceable.

As AI-generated visuals and video become commonplace, authenticity will become a critical differentiator. The challenge – and opportunity – will be finding ways to make AI-created content feel human, real and emotionally connected, so it resonates with audiences rather than feeling synthetic or generic. This will require deliberate integration of real-world details, human stories and creative direction that only people can provide.

At the same time, we could see a creative “arms race”. AI is setting a new benchmark for production quality, making “Hollywood-style” CGI-level video and immersive visuals accessible to even the smallest brands on a fraction of the traditional budget. As the bar for quality rises, agencies will be pushed to compete not just on production polish, but on creativity, boldness and the ability to merge human insight with AI’s rapid execution.

The opportunity

Invest in AI-creative hybrid workflows that combine speed and scale with human originality.

Build proprietary creative prompts, templates and style frameworks that give AI output a distinctive, brand-aligned edge.

Explore experimental creative formats (interactive content, generative visuals, hyper-personalised assets) that AI now makes commercially viable.

Other trends in brief

Alongside the headline findings from this quarter’s Pulse, there are other shifts shaping how content marketing agencies and brands connect with audiences.

Video and visual storytelling dominance

Audiences are consuming more video than ever, pushing brands to prioritise short-form, high-impact visuals and narrative-driven content to cut through the noise.

Interactive and immersive experiences

From AR filters to 3D product demos, interactive formats are becoming a key tool for deeper engagement and brand memorability.

Centralised content management and smarter workflows

More brands are consolidating creation, management and distribution into single platforms, enabling faster turnarounds and consistent messaging across multiple channels.

Hyper-personalisation at scale

AI-driven targeting is making it possible to deliver highly tailored content journeys to thousands of people simultaneously, boosting relevance and conversion rates.

The new SEO landscape and semantic search writing

Search engines are prioritising intent and context over keywords, requiring content that answers nuanced questions in natural, topic-focused language.

The search for affordable authenticity in an AI world

As generative tools flood the market, brands are looking for ways to make AI-produced content feel human, real and emotionally resonant.

Podcasts will be the media of 2025

With YouTube emerging as the dominant podcast platform, audio-visual hybrid formats will drive reach and brand storytelling opportunities.

Thank you!

A huge thank you to everyone who took the time to complete the CMA Pulse survey. Your input is what makes this report possible and valuable. The more agencies that contribute, the sharper and more representative the insights become, so please keep taking part each quarter.

If you didn’t fill it in this time, we’d love for you to join in next time. We’ll keep producing these reports every 12 weeks and with your help they’ll only get better.

Please share this report on your socials, send it to your team and peers and use it to spark conversations about what’s changing in our industry. We hope you find it useful and we’ll see you in 12 weeks for the next CMA Pulse!

Appendix: The Data

New Client Opportunities:

The data shows a decrease in agencies reporting "More than last Q" (33% vs 42% in Pulse 1) and a significant increase in those reporting "Same as last Q" (54% vs 26% in Pulse 1).

Fewer agencies in Pulse 2 reported "Less than last Q" for new client opportunities (13% vs 32% in Pulse 1). This suggests a shift towards more stable, but less growing, opportunity pipelines in Pulse 2.

Average Conversion Time for New Opportunities:

The data shows a notable increase in opportunities converting within "1-3 months" (40% vs 23% in Pulse 1), indicating faster conversions.

Conversely, there was a decrease in opportunities converting in "3-6 months" (27% vs 58% in Pulse 1) and "6+ months" (33% vs 19% in Pulse 1), though the "6+ months" category did increase compared to Pulse 1.

Hiring Status:

A higher percentage of agencies were hiring in Pulse 2 (67% vs 52% in Pulse 1), indicating a more active hiring market in the later period.

Average Service Spend by Clients:

The data shows a significant increase in agencies reporting "Same as last Q" for average service spend (73% vs 48% in Pulse 1).

Fewer agencies in Pulse 2 reported "More than last Q" (7% vs 16% in Pulse 1) or "Less than last Q" (20% vs 36% in Pulse 1), suggesting client spend became more stable in Pulse 2, with less fluctuation.

Annual Business: Projects vs. Retained:

The data shows a higher percentage of businesses relying heavily on projects, with 36% having "1-20%" retained work (meaning 80-99% projects) compared to 23% in Pulse 1.

There was a notable increase in agencies with "More than 80%" retained business in Pulse 2 (21% vs 4% in Pulse 1), indicating a growing number of agencies with very high retained revenue.

The middle ranges ("41-60%", "61-80%") saw a decrease in Pulse 2 (7% for both categories vs 23% for both in Pulse 1).

Most Common Source of New Business:

"Referrals" remained the dominant source of new business in both pulses, with a slight increase in Pulse 2 (67% vs 61% in Pulse 1).

"Inbound marketing" and "Outbound marketing" both saw a slight decrease in Pulse 2 (13% for both vs 16% for both in Pulse 1).

"Lapsed clients" remained a minor source, staying at 7% in both pulses.

Face-to-Face Client Meetings per Quarter:

The data indicates a significant shift towards more frequent face-to-face meetings, with 67% meeting "Once per Q" compared to 45% in Pulse 1.

Categories for "2-3 times per Q" and "4-5 times per Q" saw a decrease in Pulse 2 (13% vs 36% and 0% vs 10% respectively).

"5+ times per Q" increased to 7% in Pulse 2 from 3% in Pulse 1, while "Never" increased to 13% in Pulse 2 from 6% in Pulse 1, indicating a polarisation in meeting frequency.

Mandatory Office Days:

The data shows a significant increase in agencies requiring "3" mandatory office days (40% vs 29% in Pulse 1).

There was a decrease in agencies requiring "0" mandatory days (27% vs 29% in Pulse 1) and "2" days (13% vs 26% in Pulse 1).

No agencies reported "4+" mandatory office days in Pulse 2 (0% vs 9% in Pulse 1).

AI Usage (Operations):

The data shows a notable increase in agencies using AI "Often" for operations (40% vs 26% in Pulse 1) and "Sometimes" (40% vs 42% in Pulse 1).

The use of AI "Rarely" or "Never" in operations decreased significantly in Pulse 2 (20% and 0% respectively, vs 16% for both in Pulse 1), suggesting broader adoption

AI Usage (Editorial):

AI use in editorial functions also saw an increase in the "Often" category in Pulse 2 (40% vs 42% in the Pulse 1 data, a slight decrease but still high).

The "Sometimes" category remained high at 33% in Pulse 2 (vs 32% in Pulse 1).

Agencies using AI "Rarely" or "Never" for editorial purposes also decreased in Pulse 2 (27% and 0% respectively, vs 13% for both in Pulse 1), indicating more widespread use.

AI Usage (Creative):

The most significant shift for AI use was in creative functions, where Pulse 2 shows a massive increase in agencies using AI "Often" (67% vs 32% in Pulse 1).

Conversely, all other categories ("Sometimes", "Rarely", "Never") saw a decrease in Pulse 2, with "Rarely" at 13% (vs 23% in Pulse 1) and "Never" at 7% (vs 13% in Pulse 1). This suggests AI is becoming a very common tool in creative work.